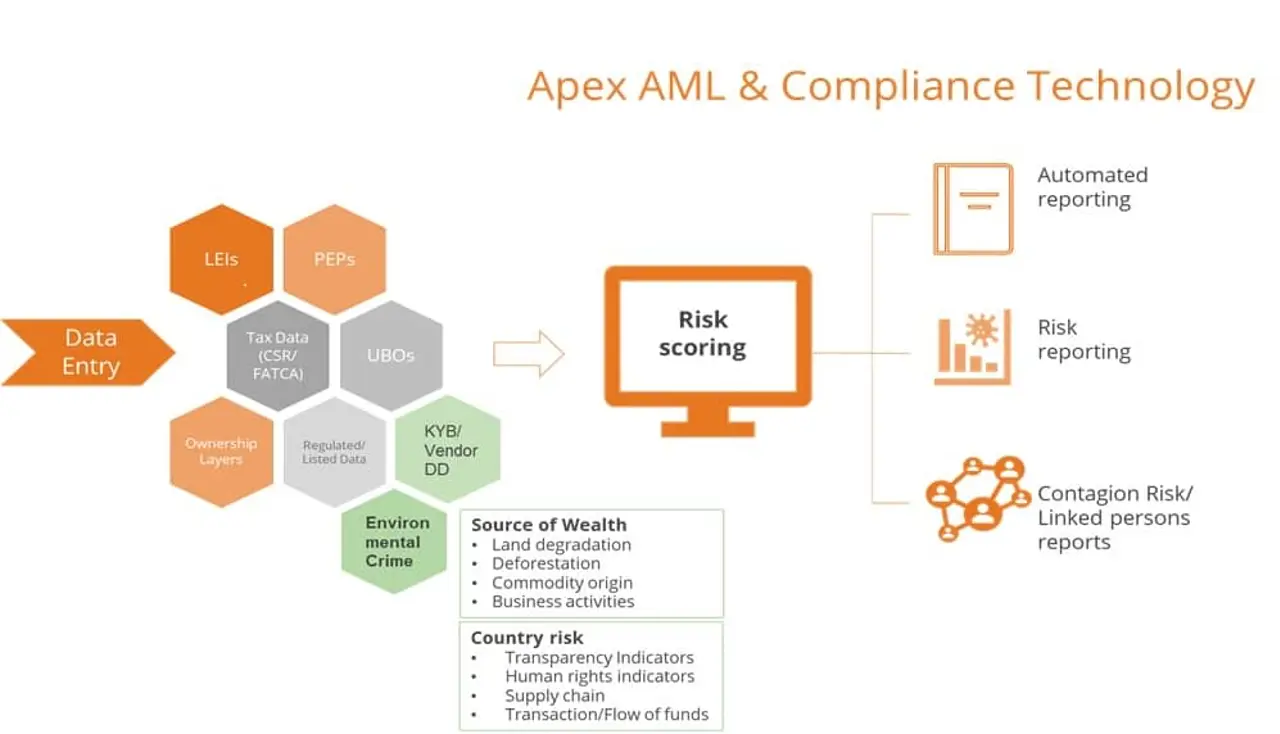

As these regulations continue to be enhanced and clearer harmonised definitions are created, there is another stream of financial services that will also be a key element in the protection of the environment and social impact - KYC.

Know Your Customer (“KYC”) and related provisions, such as Know Your Business (“KYB”) and Know Your Transaction (“KYT”), have been known to focus on understanding customers and business partners of financial services and products in terms of their identify, Politically Exposed Person (“PEP”) exposure, business activities, and source and origin of funds. Within this landscape, we see environmental crime risk as a component of KYC assessments emerging.

Environmental crime is one of the most profitable proceeds-generating crimes in the world. Every year, around 110 to 281 billion dollars in criminal gains are generated, which includes a wide range of activities such as:

- illegal extraction

- trade of forestry and minerals

- illegal land clearance and waste trafficking

Participants involved in these crimes vary from large, organised crime groups to multinational companies and individuals. Such participants rely on the financial and non-financial sector to launder the proceeds of environmental crime. Specific vulnerabilities are being noted in trade-based transactions with shell and front companies being used to disguise the proceeds of environmental crime. Environmental crime feeds into other crimes such as corruption, human security, drug trafficking and human rights violations.