2.3.1 Batch file transfers of virtual assets

For batch file transfers of virtual assets from a single originator, the above requirements shall not apply to the individual transfers of virtual assets bundled together if both of the following conditions are met:

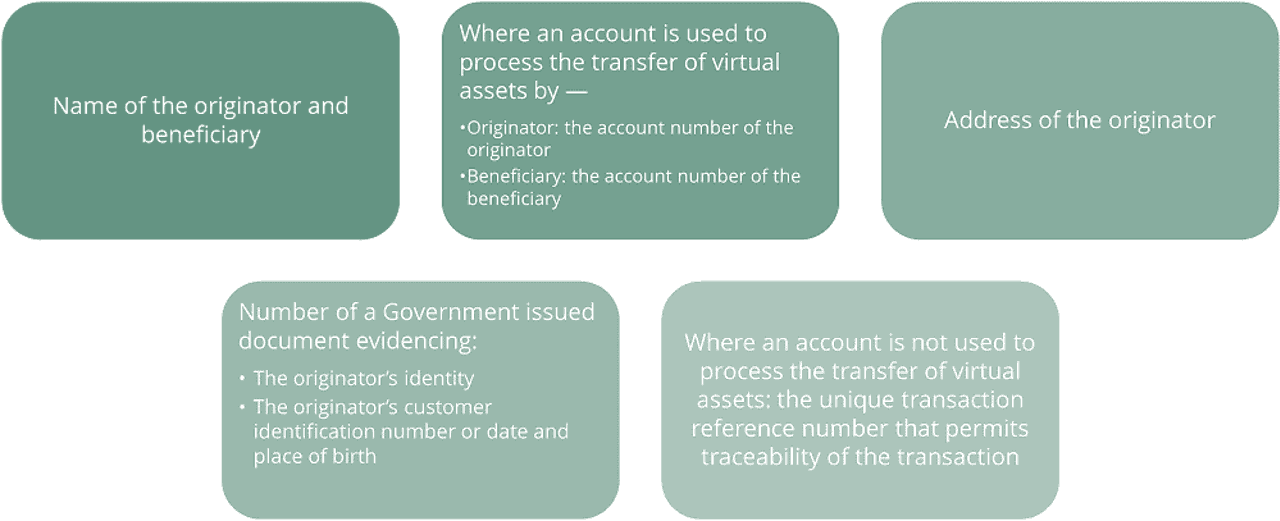

- The batch file contains:

- The name of the originator

- Where an account is used to process the transfer of virtual assets by the originator: the account number of the originator

- The address of the originator

- The number of a Government issued document evidencing the originator’s identity or the originator’s customer identification number or date and place of birth

- The individual transfers of virtual assets carry the account number of the originator or a unique identifier

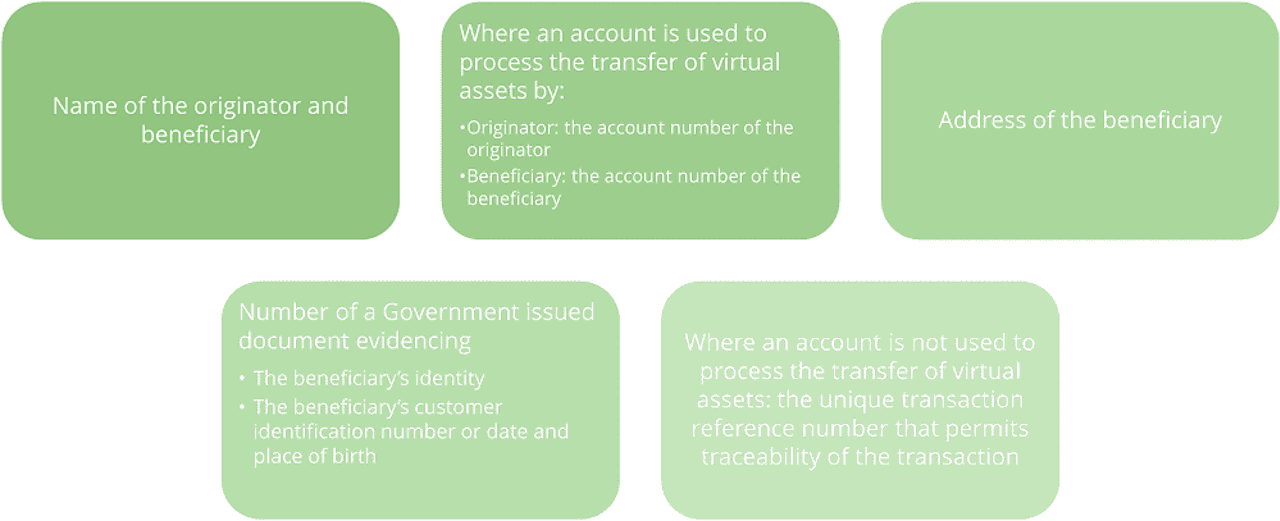

Batch files will need to contain the name, account number or unique identifier of the beneficiary that is traceable in the beneficiary country.

In addition to the above, beneficiary VASPs will also be required to

- Verify the accuracy of the information received

- Keep such information on record for at least five years

- Have effective procedures in place in order to detect whether, in the messaging or payment and settlement/equivalent system in a transfer of virtual assets, the required information shown above

Under the Revisions, the Cayman Islands specify they may ask originating and beneficiary VASPs to provide information in respect of a transfer of virtual assets.

3. Transfers of virtual assets with missing or incomplete information about the originator

Originating VASPs will not execute transfers of virtual assets where they are unable to collect information on the originator and beneficiary.

Beneficiary VASPs will be required to:

- Have effective systems in place to detect missing required information on both the originator and beneficiary

- Where detecting, while receiving transfers of virtual assets, that information on the originator required is missing or incomplete, beneficiary VASPS must do either of the following:

- Reject the transfer of virtual assets

- Request complete information on the originator

- Adopt risk-based policies and procedures for determining:

- Whether to execute, reject or suspend a transfer of virtual assets

- The resulting procedures to be applied, where the required originator or beneficiary information is incomplete

Where an originating VASP regularly fails to supply the required information on the originator, the beneficiary VASP shall adopt reasonable measures to rectify noncompliance before:

- Rejecting any future transfers of virtual assets from that originating VASP

- Restricting its business relationship with that originating VASP

- Terminating its business relationship with that originating VASP

The beneficiary VASP shall report to the Financial Reporting Authority and to the relevant Supervisory Authority any decision to restrict or terminate its business relationship with that originating VASP.

4. Suspicious Activity Reporting

A receipt of incomplete information about the originator by the beneficiary will be considered as a factor in assessing whether a transfer of virtual assets is suspicious. Should the transaction be ultimately deemed as suspicious, that transaction will need to be reported to the Financial Reporting Authority.

A VASP that controls both the originating and beneficiary VASPs shall:

- Consider the information from both originating and beneficiary VASPs to determine whether a suspicious activity report (“SAR”) should be filed

- File the SAR in the country:

- From which the transfer of virtual assets originated

- To which the transfer of virtual assets was destined

- Make relevant transaction information available to the Financial Reporting Authority and the relevant authorities in the country

- From which the transfer originated

- To which it was destined

5. Requirements for intermediaries

An intermediary VASP participating in a transfer of virtual assets will need to ensure that all information received on the originator and the beneficiary that accompanies a transfer of virtual assets is kept with the transfer of virtual assets. Intermediary VASPs will also be required to:

- Take reasonable measures, consistent with straight-through processing, to identify transfers of virtual assets that lack required originator or beneficiary information

- Adopt risk-based policies and procedures for determining, where the required originator or beneficiary information is incomplete or missing:

- When to execute, reject or suspend a transfer of virtual assets and the resulting procedures to be applied from this decision

- Keep a record of all information received from the originating VASP, obliged entity or other intermediary, for at least five years if technical limitations prevent them from sending the required originator or beneficiary information with the transfer of virtual assets

6. Reporting requirements of Supervisory Authorities

The Revisions introduce a new section focusing on annual reporting requirements for Supervisory Authorities. Those reports will need to be submitted to the Anti-Money Laundering Steering Group no later than three months after the Supervisory Authority’s financial year-end.

Such annual reports will cover:

- Number of persons (legal and natural) supervised by the Supervisory Authority

- Relevant financial business carried on by persons supervised by the Supervisory Authority and its methodology for risk rating such persons

- Number of contraventions of the Regulations by persons supervised by Supervisory Authority

- Number of inspections of persons for the purposes of the Regulations conducted by the Supervisory Authority

- Number and amount of fines imposed by the Supervisory Authority

- Number of times that the Supervisory Authority has exercised its enforcement powers

- Number of persons under the supervision of the Supervisory Authority who, following the exercise of enforcement powers by the Supervisory Authority, have contravened the requirements imposed by such enforcement measures

- Activities that the Supervisory Authority has engaged in to educate persons under its supervision with respect to their responsibilities under the Regulations

- AML/CFT and combating proliferation financing training and development undertaken within the Supervisory Authority

- Summary of any AML/CFT and combating proliferation risk assessments conducted for sectors under the supervision of the Supervisory Authority during the relevant period

- Any updates to the description of indications which may suggest that a transfer of criminal funds is taking place in the sectors under the supervision of the Supervisory Authority

How can we help you

- AML Assurance

- Managed Due Diligence