This is a best-practice framework for firms to disclose their climate transition plans, and how they intend to transition their operations and value chains to net zero. It represents a potentially vital contribution to the UK’s target of Net Zero by 2050 and may also influence transition planning and disclosure well beyond the UK’s shores.

Here we provide an overview of the published framework and the implications for financial service providers.

What is the TPTF?

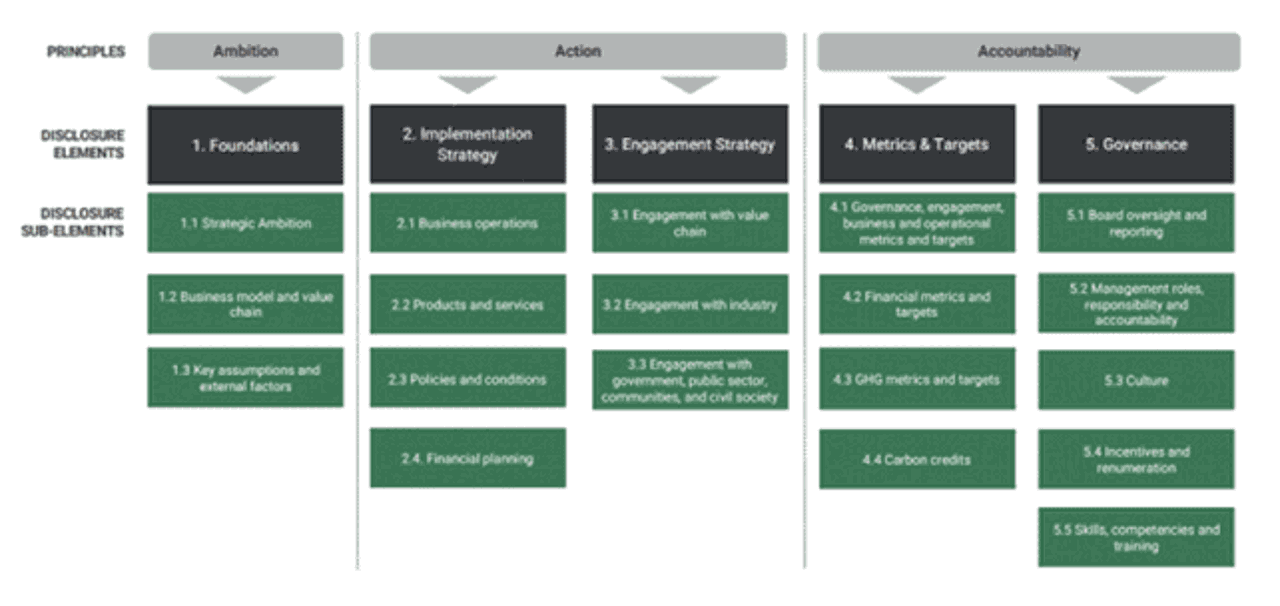

The Transition Plan Taskforce Framework (“TPTF”) builds on recommendations from the Taskforce for Climate-related Financial Disclosures (“TCFD”), the Glasgow Financial Alliance for Net Zero (“GFANZ”) and the International Sustainability Standards Board (“ISSB”). Having been specifically designed to complement the ISSB’s International Financial Reporting Standards (“IFRS”) S2, the TPTF is intended to assist entities in making their transition planning disclosures. Furthermore, in March of this year, the UK Government reaffirmed its intention of implementing compulsory reporting aligned with the ISSB standards (HM Government 2023).

The Financial Conduct Authority (“FCA”) has endorsed the TPT framework, describing it as "a set of good practice recommendations to help companies across the economy make high quality, consistent, and comparable transition plan disclosures" (Financial Conduct Authority 2023).

Who is affected by this?

Listed companies, asset managers, and asset owners will be affected by the TPTF. Detailed sector-specific guidance is expected by the end of this month for asset management, asset owners, and banking sectors, as well as food and beverage, electric utilities and power generators, metals and mining, and oil and gas.

Financial service providers in the scope of the FCA’s upcoming Sustainable Disclosure Requirements will also be impacted by the TPTF. Following implementation, the metrics used within assets’ transition plans could be incorporated into the key performance indicators (“KPIs”) leveraged by firms with “Sustainable Improvers” funds.

The TPTF’s potential reach extends beyond the UK. The Corporate Sustainability Reporting Directive and the expected Corporate Sustainability Due Diligence Directive both require disclosures regarding transition plans for in-scope companies. While developed with the UK economy in mind, the TPTF is also deliberately designed to be transferable and is the first such national- level transition framework to emerge globally. It might be anticipated, therefore, that the framework may be leveraged to inform these EU requirements. Even if not formally adopted by the EU, the framework may become a de facto “standard” for companies in the absence of any competing guidance.