What are private cat bonds?

A cat bond is a financial instrument that transfers catastrophe risk from an insurance or reinsurance company to investors. This risk transfer helps insurers or reinsurers manage their exposure to natural disasters, such as hurricanes, earthquakes, or floods. They are structured as tradable securities, with the bond's principal tied to the occurrence of a pre-defined catastrophe event.

In the event of a qualifying catastrophe, the issuer can use the bond's principal to cover their losses, and the investors will lose all or part of their principal. If the pre-defined event does not occur, investors receive periodic interest payments and the return of their principal at the end of the bond's term.

What is collateral reinsurance?

Collateral reinsurance is a private and bilateral contract between an insurance or reinsurance company (the cedent) and a reinsurer. The reinsurer, in this case, is often an ILS fund or a special-purpose vehicle (“SPV”) backed by institutional investors. These contracts provide protection for specific risks, such as a particular catastrophe event, in exchange for a premium paid by the cedent.

In this structure, the reinsurer posts collateral, usually in the form of cash or high-quality securities, to cover the maximum potential liability under the contract. If the specified risk event occurs, the cedent can access the collateral to cover its losses. If the risk event does not occur, the collateral is returned to the reinsurer at the end of the contract period, along with any interest earned.

Key differences

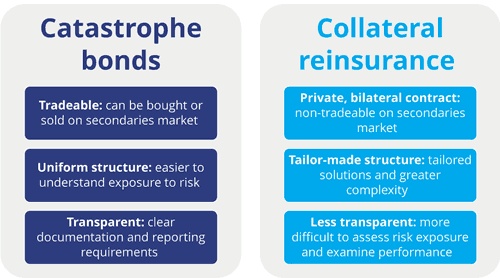

- Private cat bonds are tradable securities, which allows investors to buy or sell them on secondaries markets. Collateral reinsurance contracts, on the other hand, are private and bilateral, with no secondaries market for trading.

- Cat bonds have a more consistent and uniform structure, making it easier for investors to understand and evaluate the risk involved. In contrast, Collateral reinsurance contracts are often tailored to meet the specific needs of the cedent, often making them more complex.

- Cat bonds are typically more transparent due to their public nature, with clear documentation and reporting requirements, while collateral reinsurance contracts are private and often less transparent in terms of risk exposure and performance metrics.

Which structure is best?

Both structures provide investment opportunities within the ILS market, but generally private cat bonds are considered more beneficial and transparent for investors. The tradeable nature of these securities, consistent structure, and transparency makes it easier for investors to evaluate, monitor, and manage their exposure to catastrophe risk.

Collateral reinsurance, despite offering tailored solutions to cedents, can be more challenging for investors to evaluate due to the lack of consistency, uniformity, and transparency. However, these contracts can be an attractive investment for sophisticated investors comfortable with the complexity and seeking diversification within their ILS portfolio.

Catastrophe bonds or collateral reinsurance? Key features to help investors decide:

How can Apex Group help?

We offer a comprehensive range of services to insurance-linked securities and vehicles. Our single-source solution is designed to provide our clients with an efficient and cost-effective way to manage their needs.

Our services include:

- Support through fund lifecycle

- Insurance management

- Transformation services

- Corporate services

- Fund administration and investor services

- Regulatory compliance and tax reporting

- Treasury/collateral management

- ESG ratings, advisory and reporting

For our full list of disclaimers, click here.