We summarise the latest changes for you covering:

- EU Sustainable Finance- April Package

- EU– Corporate Sustainability Reporting Directive (CSRD)

- EU– Taxonomy Climate Delegated Act

- Financial Conduct Authority: MIFID

- FCA Climate Change and Sustainable Finance

EU Sustainable Finance- April Package

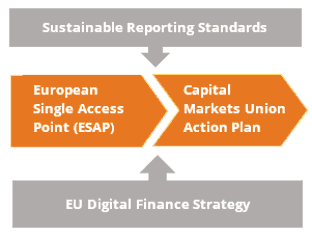

To continue to facilitate the re-orienting of investment towards sustainable technologies and businesses, the EU announced a series of further changes:

- EU Taxonomy Climate Delegated Act

- Corporate Sustainability Reporting Directive (CSRD)

- Six amending Delegated Acts

The highlights of the changes are set forth below:

|

Proposed Corporate Sustainability Directive (CSRD)

|

· Extends scope of the NFRD for reporting companies listed on regulated markets (except listed micro-enterprises) · Requires the audit (assurance) of reported information · Introduces more detailed reporting requirements in line with EU sustainability reporting standards · Requires companies to digitally ‘tag’ reported information to feed into the European single access point |

|

EU Taxonomy Climate Delegate Act

|

Clarification on which economic activity most contributes to the EU’s environmental objectives reflecting climate change mitigation and climate change adaptation. |

| Sustainability Amendments- Delegated Acts |

Enhancement to directives relating to suitability and appropriateness assessments and product governance to ensure investors/consumers sustainability preferences are taken into consideration · Delegated Directive 2010/43/EU- Sustainability factors for UCITs · Delegated Regulation amending Delegated Regulation EU No. 231/2013- Sustainability risks and sustainability factors by AIFM’s · Delegated Regulation amending Delegated Regulations EU2017/2358 and EU2017/2359- integration of sustainability factors, risks and preferences into the product oversight and governance requirements for insurance and insurance based investment products · Delegated Directive amending Delegated Directive EU2017/593- integration of sustainability factors into product governance obligations · Delegated Regulation amending Delegated Regulation EU2015/35- integration of sustainability risks in the governance of insurance and reinsurance obligations · Delegated Regulation amending Delegation Regulation EU2017/565- integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms. |

|

Amendments to Delegated Acts

|

|||||

| Directive 2010/43 | Regulation 231/2013 | Regulations 2017/2358 & 2017/2359 | Directive 2017/593 | Regulation 2015/35 | Regulation 2017/565 |

| Sustainability risks and sustainability factors to be considered for UCITs | Sustainability risks and sustainability factors to be considered by AIFM’s | Sustainability factors, risks and preferences into the product oversight and governance requirements for insurance undertakings and insurance distributors and into the rules on conduct of business and investment advice for insurance-based investment products | Integration of sustainability factors into the product governance obligations | Integration of sustainability factors into the governance of insurance and reinsurance undertakings | Integration of sustainability factors, risk and preferences into certain organizational requirements and operating conditions for investment firms |

EU– Corporate Sustainability Reporting Directive (CSRD)

Integrity of Sustainability Reporting

‘The transition to a sustainable economy is likely to mean that collecting and sharing sustainability information becomes common business practice for companies of all sizes’

The EU indicated that the absence of clear sustainability reporting policy will increase the gap between user’s information needs and sustainability information, consequently, a proposal to amend Directive of the European Parliament and of the Council amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation EU 537/204 as regards corporate sustainability reporting.

The proposals put forth, followed an evaluation of the scope of the Non-Financial Reporting Directive (NFRD) which requires large companies to report sustainability information on an annual basis with a ‘double’ materiality provision, meaning that companies have to report about how sustainability issues affect their business and about their own impact on people and the environment- however evidence suggests that the relevant information is omitted which may also be due to the lack of precision in the current requirements given the large number of private and variable frameworks.

The over-arching objectives and changes of the amendments are:

- Extends scope of the NFRD for reporting companies listed on regulated markets (except listed micro-enterprises)

- Requires the audit (assurance) of reported information

- Introduces more detailed reporting requirements in line with EU sustainability reporting standards

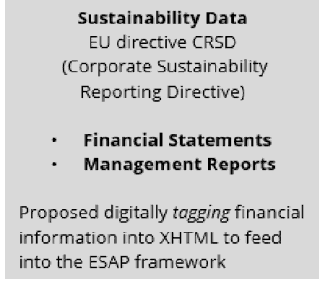

- Requires companies to digitally ‘tag’ reported information to feed into the European single access point (ESAP)

|

|

Summary of the salient changes:

| Scope of the NFRD [2014/95] |

Scope of the NFRD applies primarily to public interest entities, listed companies, banks and insurance companies. The NFRD applies to ‘large’ companies that have more than 500 employees, therefore the NFRD only covered approximately 11,000 entities. The CSRD proposes to expand the scope of coverage to increase beyond the current NFRD in-scope entities to SME’s but excluding listed micro-enterprises. |

| Scope of additional reporting requirements |

Additional reporting would apply to SME’s with securities listed on regulated markets using simpler standards than currently apply to larger listed entities. SME’s listed on EU regulated markets would have a phasing-in period to accommodate the COVID-19 implications for such SME’s. Reporting requirements would NOT apply to SME’s with transferable securities listed on SME growth markets or multilateral trading facilities (MTFs). Non-listed SME’s may choose to voluntarily use the simpler reporting that is intended to apply to listed SME’s. |

| Standard setting Body |

The European Financial Reporting Advisory Group (EFRAG) will be responsible for developing the draft standards. EFRAG aim to have the first draft standards ready by mid-2022. These standards would take into account the global work on alignment of sustainability reporting across IFRS, GRI, SASB, IIRC, CDSB and CDP. |

| Alignment with SFDR and Taxonomy | The proposed CSRD would take into consideration the Taxonomy and SFDR- particularly Article 8 of the SFDR where information must be reported on how the activities are sustainable building on the ‘substantial contribution’ and ‘do-no-significant-harm’ criterion of the Taxonomy regulations. |

| Proposed EU-wide audit assurance |

The proposals aim to introduce an EU-wide audit requirement for reported sustainability information, based on a progressive approach to implementation. This will help to ensure that reported information is accurate and reliable. Limited assurance approach initially, but could move to a requirement for reasonable assurance standard if the Commission adopts sustainability assurance standards. The Commission’s proposals allows Member States to open up the market for ‘sustainability assurance services providers’ to firms other than usual auditor’s financial information to assure sustainability information. |

| Digitalization of sustainability data | To reflect increasing digitalization, the Commission is proposing that financial statements and their management report in XHTML format in line with the ESEF and tag their reported sustainability information to a digital categorisation system, when specified by the ESEF. |

| Timelines |

Mid 2022- EFRAG intends to issue the first draft of the standards End 2022- First set of reporting standards released, subject to Council approval 2023- Standards would apply 2024- First audit reports released using the new reporting standards |

|

Proposed Amendments

|

||||||

|

Amendments to EU 2013/34 [Accounting Directive] |

||||||

| Article 19a |

Sustainability Reporting Information to be included in management reports to understand the undertakings impact on sustainability matters, and information necessary to understand how sustainability matters affect the undertaking’s development, performance and position. Relevant exemptions apply for consolidated management reports for group entities. |

Applies to large undertakings, and SME’s from January 1, 2026 |

||||

| Article 19b |

Sustainability Reporting Standards

The Commission shall adopt sustainability reporting standards specifying the information that undertakings are to report in accordance with Article 10a and 29a, and the structure in which the information shall be reported. The sustainability reporting standards should specify the information that undertakings are to disclose about a) environmental factors, including information about: · Climate change mitigation · Climate change adaptation · Water and marine resources · Resource use and circular economy · Pollution · Biodiversity and ecosystems b) Social factors c) Governance factors |

|

||||

| Article 19d |

Single electronic reporting format Undertakings subject to Article 19a shall prepare their financial statements and management report in a single electronic format in accordance with Article 3 EU 2019/815 and mark up their sustainability reporting in accordance with Article 8 of EU2020/852 Undertakings subject to Article 29a shall prepare their consolidated financial statements and their consolidated management report in a single electronic format in accordance with Article 3 EU 2019/815 and mark up their sustainability reporting in accordance with Article 8 of EU2020/852 |

|||||

| Article 29a |

Consolidated Sustainability Reporting

Parent undertakings of large groups shall include consolidated management report information necessary to understand the group’s impacts on sustainability matters, and information necessary to understand how sustainability matters affect the group’s development, performance and position. |

|||||

| Article 51 |

Penalties Member States must set forth penalties for infringement. |

|||||

| Other amendments proposed |

· Amendments to Directive 2004/109/EC · Amendment to Directive 2006/43/EC · Amendment to Regulation EU 537/2014 |

|||||

EU– Taxonomy Climate Delegated Act

The EU Commission issued supplementing regulation to EU2020/852 (Taxonomy) and defining technical screening to determine the conditions under which an economic activity qualifies as contributing substantially to climate change mitigation or climate change adaptation and for determining whether that economic activity causes no significant harm to any of the other environmental objectives.

The changes present technical clarifications and simplifications of those criterion in response to feedback and comment received. Technical standards for agriculture being delayed to accommodate further negotiations for the common agriculture policy (CAP).

The supplemental changes to the Taxonomy regulations are set forth below:

| Article 1 | Technical screening when conditions under which an economic activity qualifies as contributing substantially to climate change mitigation and for determining whether that economic activity causes no significant harm to other environmental objectives in Article 9 |

| Article 2 | Technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to climate change adaptation and for determining whether that economic activity causes no significant harm to any other environmental objectives in Article 9. |

| Annex 1 | Technical screening criteria for economic activity qualifying as contributing significantly to climate change mitigation and whether that economic activity causes no significant harm to any of the other environmental objectives. |

| Annex 2 | Technical screening criteria for economic activity qualifying as contributing significantly to climate change adaptation and whether that economic activity causes no significant harm to any of the other environmental objectives. |

Financial Conduct Authority

Changes to UK MIFID’s conduct and organizational requirements (CP21/9)

- The FCA is consulting on changes to the conduct and organisational aspects of MiFID addressing the ‘quick-fix’ EU package. The proposals will be of specific interest to:

- Investment firms and market operators in the UK

- Banks and Collective Investment Scheme operators providing investment services, persons providing investment advice and reception and transmission of orders who did not opt into MiFID (Article 3 firms)

- Persons providing research that the FCA does not authorize.

SME and Fixed Income, Currencies and Commodities (FICC) Research

- Proposed changes to inducement rules relating to research broadening the definition of non-monetary benefits to include research on SME’s with a market cap below GBP200 m and FICC research so that it is not subject to the inducement rules.

- How inducement rules apply to openly available research and research provided by independent research providers

Best Execution Reports (RTS 27 and 28)

- Proposal to remove reporting requirements relating to best execution, RTS 27 and RTS 28 reports.

These proposals are in line with the capital markets reform work covering priority items such as:

- Market structure

- Pre-and post-trade transparency for shares, bonds and derivatives

- Cost and distribution of market data

- Commodity derivatives markets

FCA Climate Change and Sustainable Finance

The UK FCA reminds the market of the objective of its sustainable finance following the Chancellors letter addressed to the FCA, on March 23, 2021, which set forth the government’s desire to deliver a financial system which supports and enables a net-zero economy by mobilizing private finance towards sustainable and resilient growth and resilient to the physical and transition risks that climate change presents. The FCA is to have regard to the government’s commitment to achieve a net-zero economy by 2050 under the Climate Change Act 2008 (Order 2019). In this regard, the FCA highlighted the sustainable finance strategy as incorporating the following 3 core components: strategy being:

- Transparency- promoting good disclosures along the investment chain;

- Trust- Ensuring that the market delivers sustainable finance instruments and products that genuinely meet investors’ sustainability preferences;

- Tools- Government, regulators and industry all working together to share experience develop guidance and tools, and provide mutual support as we address the challenges of climate change.

Keep up to date with the latest updates

We encourage you tosubscribe to our Regulatory Updates to keep up to date with global regulatory changes affecting your business.

Contact us now to learn more about what we can offer you.